Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation  Link Technologies - LinkSOFT Documentation

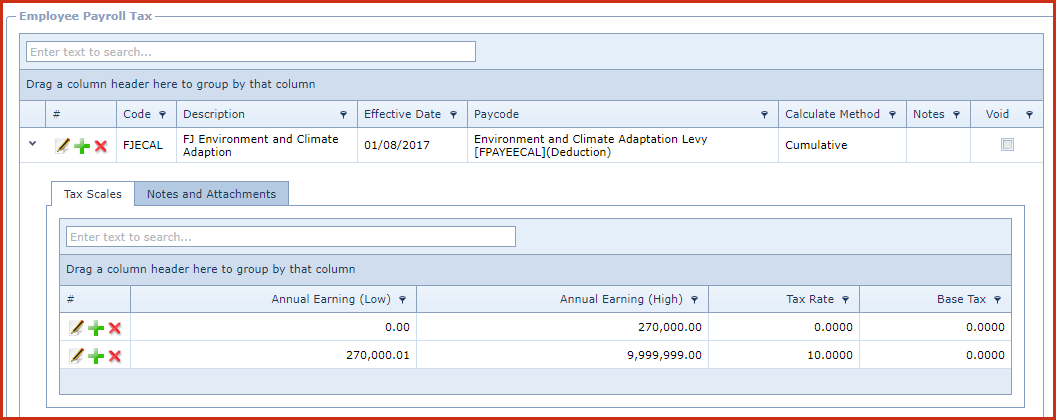

Link Technologies - LinkSOFT Documentation Steps to create payroll tax:

Papua New Guinea has the following additional fields for calculating employee payroll tax. These additional fields are automatically created when the company address has country as "Papua New Guinea".

Field Name Description 1 Dependant -

A

Dependants Rebate = Max of ([A]

or Min of ([B]%*Gross Tax or [C])

Enter the value for [A]

1 Dependant - B

Dependants Rebate = Max of ([A] or Min of ([B]%*Gross Tax or

[C])

Enter the value for [B]

1 Dependant - C

Dependants Rebate = Max of ([A] or Min of ([B]%*Gross Tax or

[C])

Enter the value for [C]

2 Dependant - A

Dependants Rebate = Max of ([A] or Min of ([B]%*Gross Tax or

[C])

Enter the value for [A]

2 Dependant - B

Dependants Rebate = Max of ([A] or Min of ([B]%*Gross Tax or

[C])

Enter the value for [B]

2 Dependant - C

Dependants Rebate = Max of ([A] or Min of ([B]%*Gross Tax or

[C])

Enter the value for [C]

3+ Dependant - A

Dependants Rebate = Max of ([A] or Min of ([B]%*Gross Tax or

[C])

Enter the value for [A]

3+ Dependant - B

Dependants Rebate = Max of ([A] or Min of ([B]%*Gross Tax or

[C])

Enter the value for [B]

3+ Dependant - C

Dependants Rebate = Max of ([A] or Min of ([B]%*Gross Tax or

[C])

Enter the value for [C]

Gross Adjustment

Gross amount adjustment before calculating

tax.